Hello, HoneyJar.

Posted onI’m thrilled to announce that HoneyJar, our first app for iPhone and iPod touch, has been released for sale.

You give every dollar you spend a job, whether you realize it or not.

In fact—if you want to take it to the extreme—you can argue that every dollar that isn’t working for you, is working against you. It’s keeping you from an early retirement. It’s keeping you from financial independence.

It’s keeping you from enjoying your life.

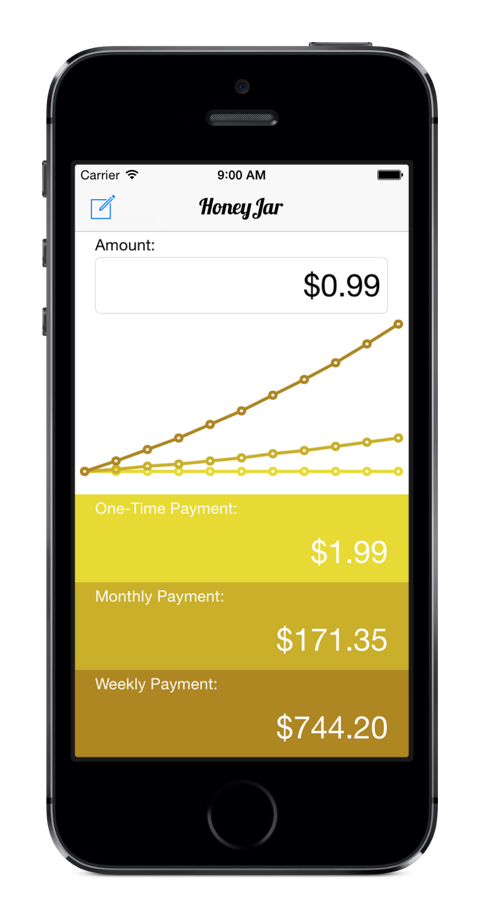

Using HoneyJar is easy. Simply enter an amount you’re spending (or thinking of spending) and HoneyJar shows you what it really costs you as a one-time payment, what it costs you to pay that much every month, and what it costs you to pay that much every week.

Change the rate of interest and the number of years over which the calculations are made to evaluate different scenarios. Press and hold any point on the graph to how your savings grow.

HoneyJar takes the power of future-value calculation, wraps it in a beautiful package, and puts it in your pocket.

You know that your money can work way harder than you can. But is it working smarter?

Let’s look at some examples of how HoneyJar can help you better evaluate the jobs that you give to your hard-earned dollars:

The real cost of leaving cash in your checking account

Most personal checking accounts offer a fraction of a percent interest on the balance.

Let’s be generous and pretend you get a 0.25% interest rate on a $1,000 deposit that you maintain in your checking account. Plug that into HoneyJar over ten years, and you’ll see that $1,000 amount is worth $1,025.31 if you don’t touch it.

If you invested it at a typical 7% instead, you’d more than double your money—$2,009.66—after ten years. Keeping that money in your bank account cost you $984.35!

And when you factor in the rate of inflation (right now around 2%)? You’re losing money by keeping it in your checking account.

What kind of return (or savings) you need to make on a one-time purchase

You’re a writer and you’re considering a glitzy new $500 pen.

It’s beautiful, built like a tank, and it writes really nicely. The kind of thing that becomes a family heirloom.

And writing is your livelihood, right? So you feel it’s worth the splurge. If anything, having such an awesome writing instrument will motivate you to write more.

So how much more writing do you need to do to make it a worthwhile purchase?

Well, had you invested that $500 at a typical 7% over, say, the expected 25-year life of that pen, you’d have $2,862.71 in your investment account.

That’s how much more writing you’ll have to do. It’ll have to earn you nearly six times its purchase price!

How much value to put on that fancy coffee you buy every weekday morning

You know those $4 coffees? The ones you have five days a week?

Think that’s costing you $4 times 5 days a week times 52 weeks a year?

Guess again!

In reality, the cost of not investing that money instead is costing you $6,218.62—over $1,000 more—over only five years. Over a twenty-year career, it’s costing you over $45,000!

Filed under: honeyjar