HoneyJar is an app for iPhone that helps you figure out the real cost of your spending.

While no longer available for sale, HoneyJar was a future-value calculator inspired by one of Aesop’s fables:

A jar of honey was upset and the sticky sweetness flowed out on the table. The sweet smell of the honey soon brought a large number of Flies buzzing around. They did not wait for an invitation. No, indeed; they settled right down, feet and all, to gorge themselves. The Flies were quickly smeared from head to foot with honey. Their wings stuck together. They could not pull their feet out of the sticky mass. And so they died, giving their lives for the sake of a taste of sweetness.

The moral of the story is that a little pleasure today may come at a great cost tomorrow.

That sucks for the flies, but what does it have to do with me?

The short answer is that you make decisions every day that affect your future, either positively or negatively.

Unfortunately, though, we’re generally lousy at understanding just how those decisions impact our future. This is especially true when it comes to our money.

Whether you realize it or not, you put every dollar you earn to work. How? By choosing how you spend it. You can spend it right away for an immediate benefit, you can leave it in your checking account for a short-term benefit, or you can invest it for a long-term benefit.

Enter HoneyJar. By showing you the real difference between spending today and investing for tomorrow, HoneyJar helps you better decide how to put your money to work.

Okay, so how do I use HoneyJar?

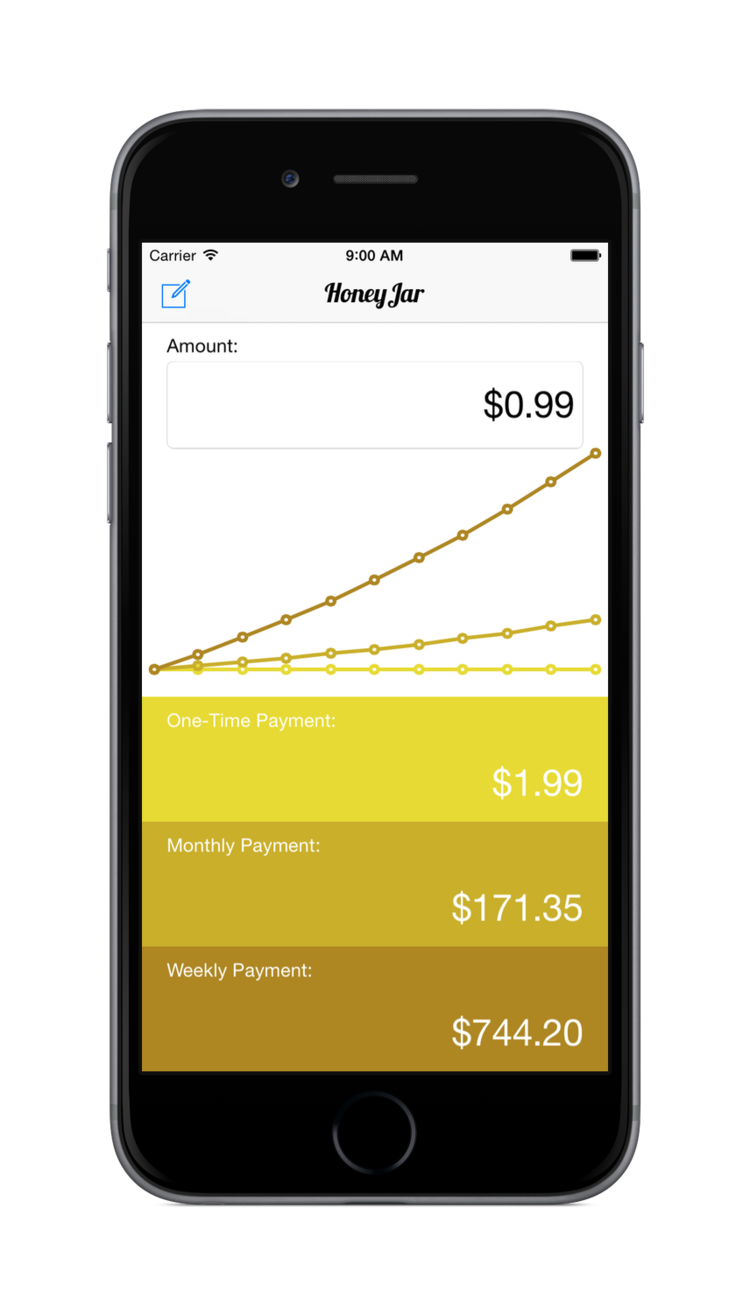

Using HoneyJar is easy. Just enter the expense in the Amount field and HoneyJar will show you its future value—that is, how much it would really cost you—for three scenarios:

- A one-time payment

- A recurring monthly payment

- A recurring weekly payment

Every dollar that you spend is a dollar that you’re not investing. And thanks to the power of compounding interest, it adds up a lot faster than you’d think: if you invest $7 per week (or a dollar a day) at a typical 7% rate of return, the value of that isn’t simply $7 × 52 weeks × 20 years = $7,280. It’s more than double that—over $15,800!

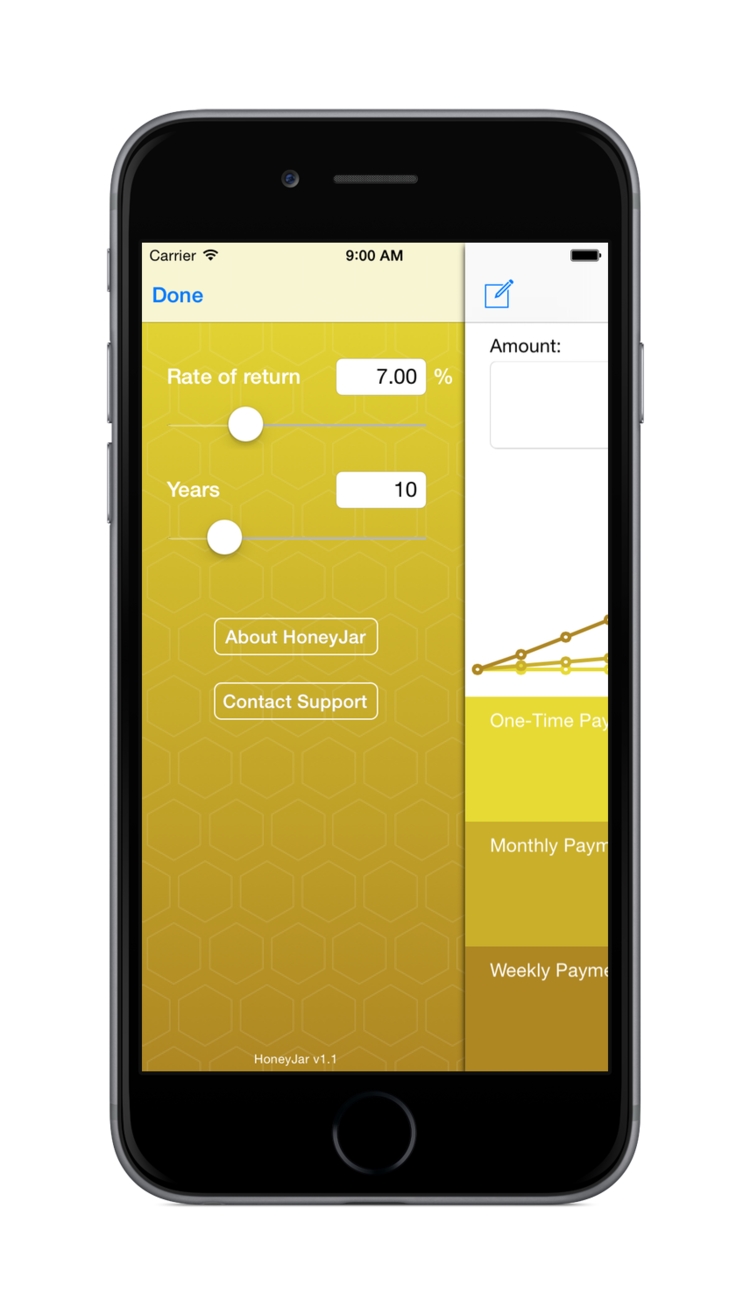

While HoneyJar defaults to a 7% rate of return over ten years, you can change the period (in years) and the rate of return (in percent) by tapping the Edit button in the navigation bar and changing these values. When you’re done, just tap on the Done button in the navigation bar to recalculate the costs.

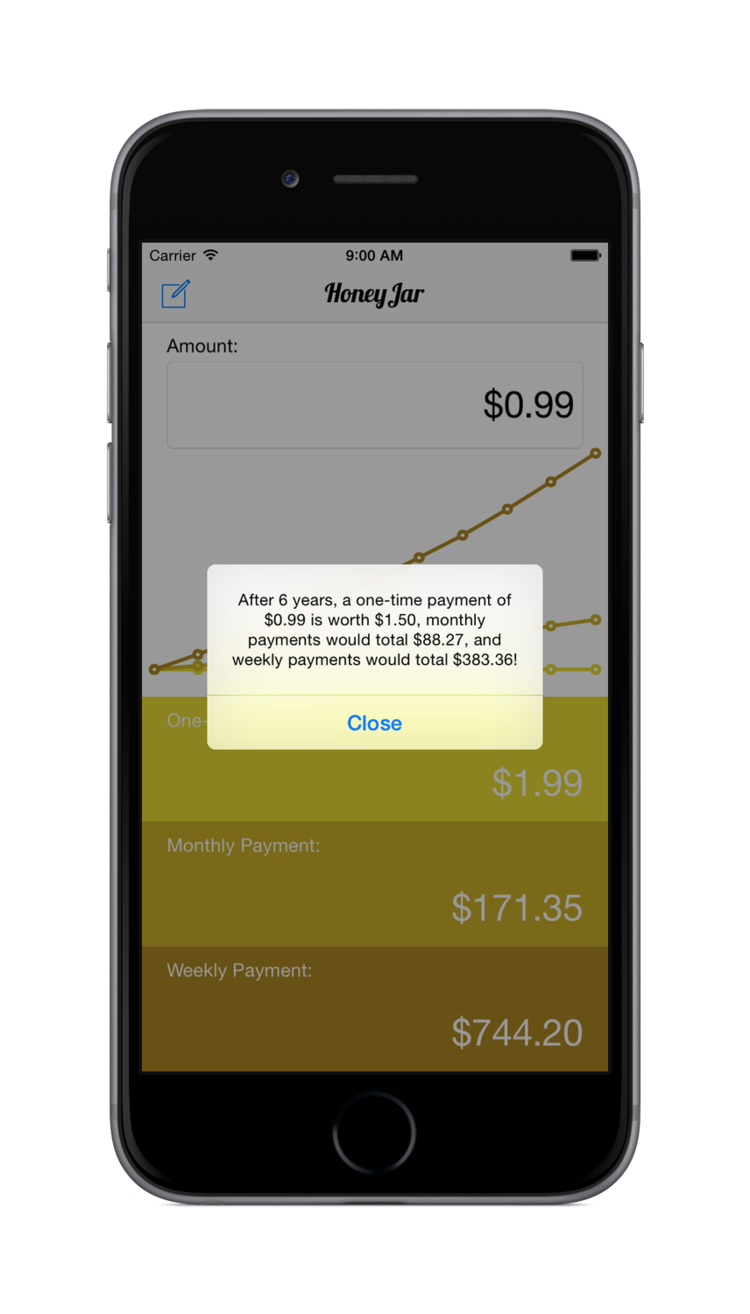

Want to see how the value grows over time? Tap and hold any spot in the graph to get details on what that amount would be worth at that point in time.

That much makes sense, but how about some real-life use cases?

HoneyJar can help you better understand

- the real cost of leaving cash in your checking account

- what kind of return (or savings) you need to make on a one-time purchase

- which credit card to pay off first

- how much value you should put on that fancy coffee you buy every morning

HoneyJar doesn’t give you financial advice and won’t solve your money problems. But HoneyJar is a tool that can help you make smarter spending decisions.

I have a question that’s not covered here.

You should definitely get in touch via e-mail or Twitter and let me know how I can help.